1.4 Valuation Flashcards

(57 cards)

What is compounded interest?

Where we add the interest from each period to the principal so that it also accrues interest in the next period.

If one has value P today, invested at rate r for n years, what is the final value?

What is the difference between compounding and discounting?

Compounding: we take present value and calculate the future value.

If one receives value F for n years, discounted at rate r, what is the present value?

PV=F÷(1+r)^n

What do we normally do in discounting?

As it is usually regular inflows of payments, we sum the values of each individual year.

Baseline case: Certain cash flows, flat (time-invariant) discount rate.

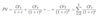

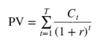

What is the formula for calculating present value?

What are considered to be risk-free securities?

Why?

US

- Fiscal instruments - the power to tax the wealthiest population in the world.

- Ability to print money - will always be able to fulfil debts (although this isn’t great for obvious reasons).

Non-flat discount rate term structure

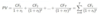

What is the formula for calculating present value?

What discount rate do we use for non-flat discount rate term structures?

Use zero-coupon bond rates (spot rates) of same riskiness as cash flows.

Uncertain cashflows

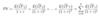

What is the formula for calculating present value?

What discount rate do we use for uncertain cash flows?

Show the cashflow diagram and the total present value for the whole strategy

Show the cashflow diagram and total present value for strategy B

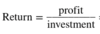

Formula for rate of return in terms of profit and investment

Discounted cash flow formula

What is the value of $200/year for eternity?

Discount rate = 5%

What is the formula for perpetuties?

Perpetuities formula proof

Rate of return formula in terms of cash flow and present value

How do we derive the perpetuities formula?

From the rate of return rate formula (r = C/PV), we rearrange so that PV is the subject.

What is an annuity?

A regular payment (it suggests annual payment but it can be any regular payment).

What is the value of $200/year for 5 years?

Discount rate is 5%.

What is the formula for annuities?

Annuity formula explained

Two perpetuities. One starts now (t=0), with the first payment in t=1. The second starts at the end of the annuity, at t=T.