The FAR (Financial Accounting and Reporting) test is the hardest hurdle to clear on the CPA (Certified Public Accountant) Exam. FAR is a “number crunching” test that requires dozens of calculations. More calculations increase the risk of error, and that’s the challenge of FAR.

The good news is that with proper planning and the right CPA study tools, you can pass the FAR exam with flying colors.

Read on to find out how…

TL;DR: What Are The Hardest Topics On The FAR CPA Exam?

- FAR is considered the hardest CPA section due to its scope and technical detail.

- Most difficult areas: governmental accounting, bonds, pensions, leases, deferred taxes, consolidations, revenue recognition, depreciation, accruals/deferrals, and cash flows.

- The key to success is to prioritize high-weight, high-difficulty topics; revisit them often in your study rotation.

- Use digital flashcards to strengthen recall of formulas, standards, and journal entries.

Why Is The FAR Exam So Hard?

FAR requires the most hours of test prep time and covers the broadest range of test topics.

The test includes GAAP accounting concepts for business, non-profits, and governments, plus financial reporting and transactions. With FAR’s massive scope and technical detail, it’s easy to feel overwhelmed.

However, knowing the most challenging areas upfront helps you focus. It’s all about spending more time on the most tested topics.

The 10 Toughest Topics On The FAR Exam

We compiled the 10 toughest topics based on CPA review provider data, AICPA blueprints, and feedback from candidates on forums. These topics consistently trip people up due to complexity, memorization load, or tricky application.

Ready? Here we go…

FAR Topic # 1: Governmental Accounting (GASB Standards)

To understand governmental accounting, you need to change your mindset. Businesses strive to generate profits. Government entities, however, use revenue sources to provide services to the public. CPA candidates need to set aside the profit motive when studying governmental accounting.

With that said, here are some key concepts.

Fund Accounting

You can visualize fund accounting by thinking of “buckets”, with each bucket filling a particular government need.

Say, for example, that a state has a highway repair fund, and revenue is generated through highway tolls. The fund generates revenue from tolls and incurs expenses for highway maintenance and repairs. Toll fees are restricted, meaning that they can only be used for the highway repair fund.

A government entity can also generate unrestricted funds that can be used for any purpose.

Modified Accrual

Fund accounting uses the modified accrual basis of accounting.

- Revenue is recognized when it is measurable and available. In this context, “available” means that funds can be collected within the current fiscal year or quickly after the fiscal year ends.

- Expenditures are recorded when a liability is incurred, and the liability will be paid from available funds.

The modified accrual basis focuses on revenue and expenditures in the current fiscal year.

With accrual accounting, revenue is recorded when it is earned, and expenses are posted when they are incurred to generate revenue. Notice that the term “available” is not used in the accrual accounting definition.

Journal Entries

Government funds record entries when revenue is collected and when expenditures are incurred and paid. Government entities don’t carry a retained earnings balance because no profits are generated. Any “excess funds” will eventually be expenditures to fund a particular service or goal.

Fund accounting is unusual. In fact, studying fund accounting may confuse you as you study financial (for-profit) accounting! Keep the concepts straight by creating side-by-side comparison tables for fund accounting and financial accounting.

FAR Topic # 2: Bond Accounting

Bond premiums and bond discounts can be a difficult topic, particularly for CPA candidates who have not taken many finance courses.

Bond Discount

Bonds are issued at par value. For this example, assume that IBM issues a $1,000 par value, AA-rated, 10-year bond with a 6% coupon rate. AA is the bond’s credit rating, and the owner will receive $60 in annual interest ($1,000 par value X 6% coupon rate).

If interest rates increase, new 10-year bonds of similar quality (AA) will be issued with higher coupon rates. The price of the existing 6% bond will decline (maybe to $980). After all, investors can earn a higher coupon rate by buying the new bonds.

When the bond price declines, the security is selling at a discount.

Bond Premium

Okay: same scenario, but now interest rates decline. The 6% bond is more valuable because new bonds are issued with coupon rates less than 6%. The 6% bond increases in price and the bond sells at a premium (say $1,020).

To study effectively for bonds, use flashcards that list bond premiums, bond discounts, and whether the bond is priced above or below par.

FAR Topic # 3: Lease Accounting

Let’s start with the basics: A lessor leases an asset to a lessee.

When you lease a car or a vacation home, the use is limited and the time period is relatively short.

Other leases are for much longer periods, so long that the lessee “uses up” most of the value of the leased asset. Assume, for example, that a manufacturing company rents a piece of machinery that has a 10-year useful life. If the lease is for 9 years, most of the machine’s value is used up when the lease ends.

For most leases with a term of more than 12 months, a lessee recognizes a “right-of-use” (ROU) asset and a lease liability. The next step is to record the lease expense, and accountants have two choices:

- Finance lease: Separates expenses between interest expense and amortization expense. This format is similar to a mortgage loan. Each loan payment includes both interest and principal repayment.

- Operating lease: Post one entry for lease expense.

Five criteria determine if a lease is a finance lease:

- Ownership transfer: Does ownership transfer to the lessee at the end of the lease term?

- Purchase option: Is there a purchase option that the lessee is likely to exercise? In other words, is the option so attractive that the lessee can’t pass it up?

- Lease term: Is the lease term a large portion of the asset’s remaining useful life? At least 75% of the asset’s life is a good guideline for this criteria.

- Present value: Present value (PV) takes a stream of future payments and discounts them based on a discount (interest) rate. PV is a method to restate a stream of payments into current dollars. Does the present value of the lease payments equal or substantially exceed all of the asset’s fair value? Use 90% for this threshold.

- Specialized asset: Some assets are so specialized that they don’t have any alternative uses at the end of the lease term. Is that true for this leased asset?

If the answer to any of the five criteria is “yes”, the lease is a finance lease.

Master the five criteria and measurement rules using flashcards.

FAR Topic # 4: Pension Benefits

Do you have a retirement plan through work? If you do, does the plan pay a fixed pension amount each month, or does the payment depend on investment performance?

You need to know the differences between the two types of pension plans:

- Defined contribution plan: Most workers now have defined contribution plans. The employer is obligated to fund the pension plan with specific dollar amounts. The benefit paid to a retiree depends on the performance of the investments in the plan. With a defined contribution plan, the company’s liability ends once dollars are invested in the plan.

- Defined benefit plan: Far fewer workers have defined benefit plans, because the employee is liable for the benefit payments at retirement. If the invested dollars are not enough to pay the pension liability, the employer must fund the difference.

These components determine if a plan is properly funded:

- Plan contributions

- Investment earnings

- Fund expenses

- Withdrawals to pay retirees

Write down the factors that increase the pension assets and those that decrease the balance, using flashcards

FAR Topic # 5: Deferred Taxes

Deferred taxes exist because of accounting differences between book (accounting) income and tax income.

As the name implies, a permanent difference means the tax calculation will always be different. The FAR exam spends more time on temporary differences, and the most tested example is depreciation expense.

Here’s an example: accounting income recognizes $1,000 in year one depreciation. The company uses an accelerated depreciation method for taxes and posts $1,600 on the tax return. What’s the impact?

- Income: The tax return has $600 more expenses in year one, and a lower income.

- Tax expense: If the tax rate is 20%, the tax return reports $120 ($600 X 20%) lower tax liability in year one.

- Future years: In a future year, the tax return will recognize less depreciation expense and more income. That’s because the accelerated method posts less depreciation expense in later years.

Bottom line? The company has a deferred tax liability, or a higher tax liability in future years. A deferred tax asset is the opposite: The firm has a lower tax liability in a future year.

Set up the bullet points in flashcards for both deferred tax assets and deferred tax liabilities

FAR Topic # 6: Business Combinations

A company with multiple subsidiaries will have each subsidiary create financial statements. If, for example, a builder has a new construction division and a renovation division, each division has financial statements.

Elimination Entries

A consolidation means that the financial statements are combined. What’s important here is that the consolidated financial statements only report transactions with third parties. Transactions between subsidiaries (or between a subsidiary and a parent company) are excluded.

Let’s say that the one division sold equipment to another division for a $5,000 gain. The impact is removed using an elimination entry in consolidation:

- The seller’s $5,000 gain is removed from income

- The buyer’s cost basis for the equipment is lowered by $5,000

Goodwill

Goodwill may be created when a company buys another business. If the purchase price is higher than the net fair value, the difference is recorded as goodwill. Net fair value refers to the fair value of assets less the fair value of liabilities.

If Coca-Cola bought PepsiCo and paid $1 million more than the fair value of PepsiCo’s assets and liabilities, Coca-Cola would record $1 million in goodwill.

Practice mini consolidation problems daily. This area is particularly challenging and requires more time.

FAR Topic # 7: Accrual And Deferral Entries

Accrual and deferral entries are posted to comply with the accrual method of accounting.

The accrual method posts revenue when earned and expenses when incurred, regardless of when cash moves. This concept may seem strange, and many CPA candidates think revenue and expenses should be posted based on cash inflows and outflows.

Accrued Payroll

Assume that you owe workers $3,000 in payroll for the last week of December, but you won’t process payroll until January 5th of the following year.

On 12/31, you debit payroll expense and credit accrued payroll $3,000. When you pay employees on January 5th, you debit (reduce) accrued payroll and credit cash $3,000.

These entries get the expense posted in the correct year.

Unearned (Deferred) Revenue

In this example, assume that a client pays you a $5,000 deposit for a home remodeling project. You debit cash and credit unearned revenue $5,000. When you complete the project, you debit (reduce) unearned revenue and credit revenue.

These entries post revenue in the period when earned.

Create flashcards that list a brief explanation of these frequently tested journal entries:

- Accrued payroll

- Unearned (deferred) revenue

- Prepaid expenses

- Interest earned (but not yet paid)

FAR Topic # 8: Revenue Recognition

A key accounting principle is consistency, and this is particularly important for revenue recognition. When you choose a method to post revenue, stick with it. Consistently recording revenue in the same way makes your financial statements comparable from one period to the next.

Accountants recognized revenue using a five-step model. To illustrate, assume that your firm sells $20,000 in software to a client, along with $5,000 of training.

- Identify the contract: The contract must have rights and obligations.

- Identify performance obligations: You must deliver both software and training.

- Determine the transaction price: $25,000 total

- Allocate the transaction price: $20,000 software, $5,000 training.

- Recognize revenue when you complete a performance obligation: $20,000 in revenue when software is delivered, $5,000 in revenue when training is completed.

If you know a customer is not financially sound, you should delay recognizing revenue until paid in full. The conservative principle of accounting states that, when in doubt, delay posting revenue.

Make sure that you have a flashcard with the five criteria, and set up flashcards for different industries (retail, manufacturing, etc.)

FAR Topic # 9: Depreciation Methods

Depreciation expense accounts for the decline in value of tangible (physical) assets.

The FAR text always asks questions about depreciation methods, and CPA candidates often miss one important fact: Total depreciation for an asset is the same, regardless of the depreciation method you use.

Say, for example, that you’re depreciating a $50,000 machine with no salvage value. At the end of the asset’s useful life, the total depreciation expense will be $50,000. An accelerated method recognizes more depreciation earlier and less later, but the total is $50,000.

Use flashcards that define these depreciation methods:

- Straight line

- Double-declining balance

- Units of production

FAR Topic # 10: Statement of Cash Flows

The statement of cash flows begins with the beginning cash balance from the prior month’s balance sheet. Next, cash inflows and outflows are assigned to one of three categories:

- Cash flows from operating activities: Day-to-day business operations (buying inventory, collecting customer payments, and processing payroll).

- Cash flows from investing activities: Cash activity generated from buying and selling assets.

- Cash flows from financing activities: Raising money to operate the business (stock or debt issuance) and repaying funds.

The ending cash balance should equal the cash balance in the balance sheet.

When you use the direct method to create the cash flow statement, you simply review cash transactions and assign them to the three categories above.

The indirect method only applies to cash flows from operations. The indirect method starts with net income from the income statement. You then review changes in the balance sheet and make adjustments to compute cash flows from operations.

Create a list of common cash flow statement entries, including:

- Interest income payments

- Repayment of a loan

- Cash received from a customer

- Cash paid to purchase equipment

If you’re feeling overwhelmed after reading through these topics, you’re not alone.

How To Prioritize These Topics In Your Study Plan

One of the biggest mistakes FAR candidates make is treating all topics as if they deserve the same amount of study time. They don’t. Some areas are tested heavily, others only lightly. Some require a mountain of memorization, while others just cover just a few key principles.

A smarter approach is to weight your study time to match the exam. Spend most of your hours on the high-difficulty, high-value topics (governmental accounting, pensions, business combinations), while giving less space to areas with fewer exam questions. This is called the Pareto principle: 80% of your results will come from mastering about 20% of the content.

Once you’ve identified your priorities, set up a rotation schedule so you’re constantly circling back to the toughest material. FAR has too much content to “do once and move on.” Revisiting topics at intervals keeps old knowledge fresh while you’re adding new layers. Digital flashcards help you automate this process, so you’re studying exactly what you need to study today.

And finally, don’t burn out on the hard stuff alone. Mix in easier or more familiar areas to give your brain a breather. That way, you keep momentum, avoid fatigue, and still make steady progress across the full breadth of the exam.

Are Flashcards a Good Study Tool for the FAR’s Hardest Topics?

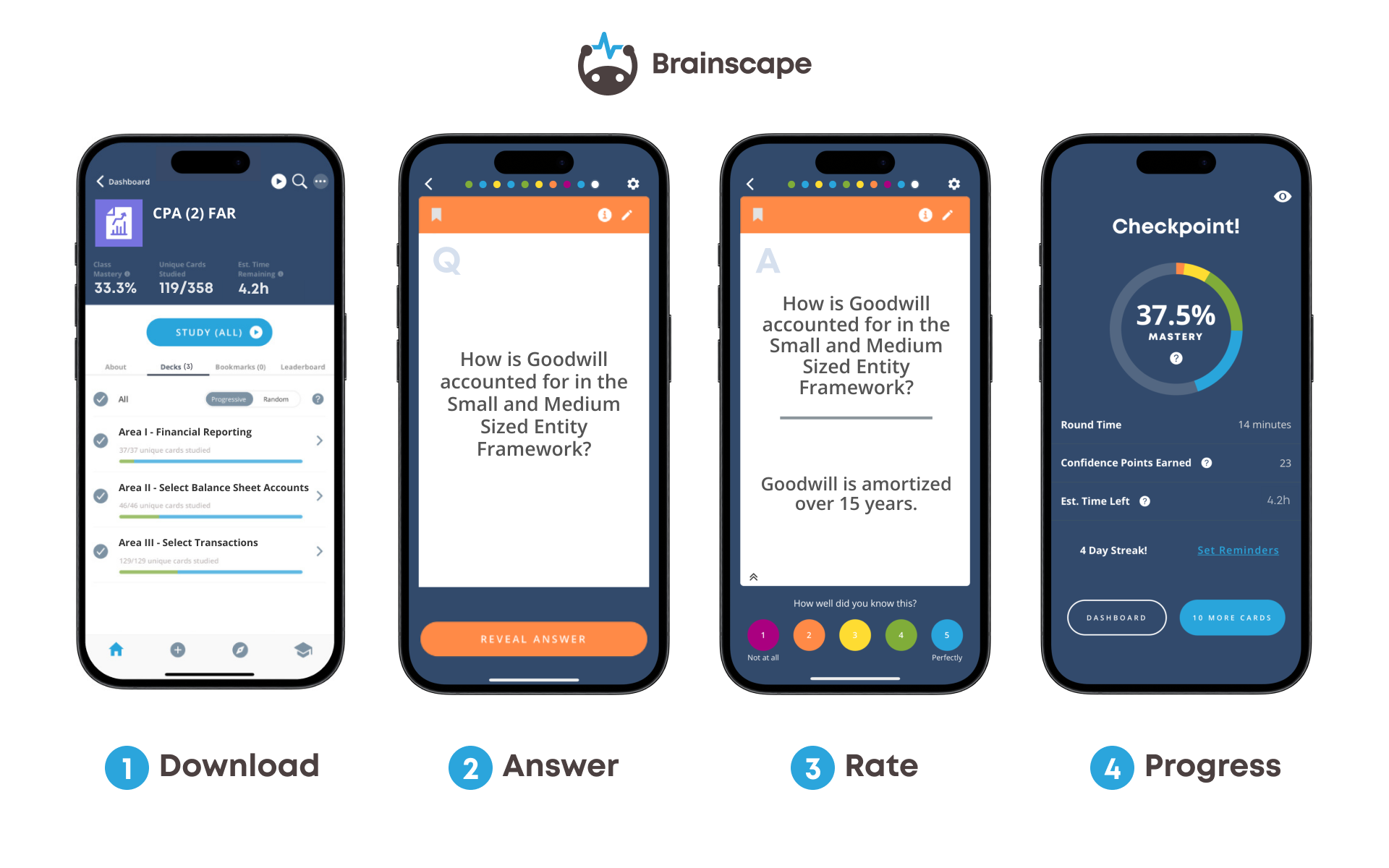

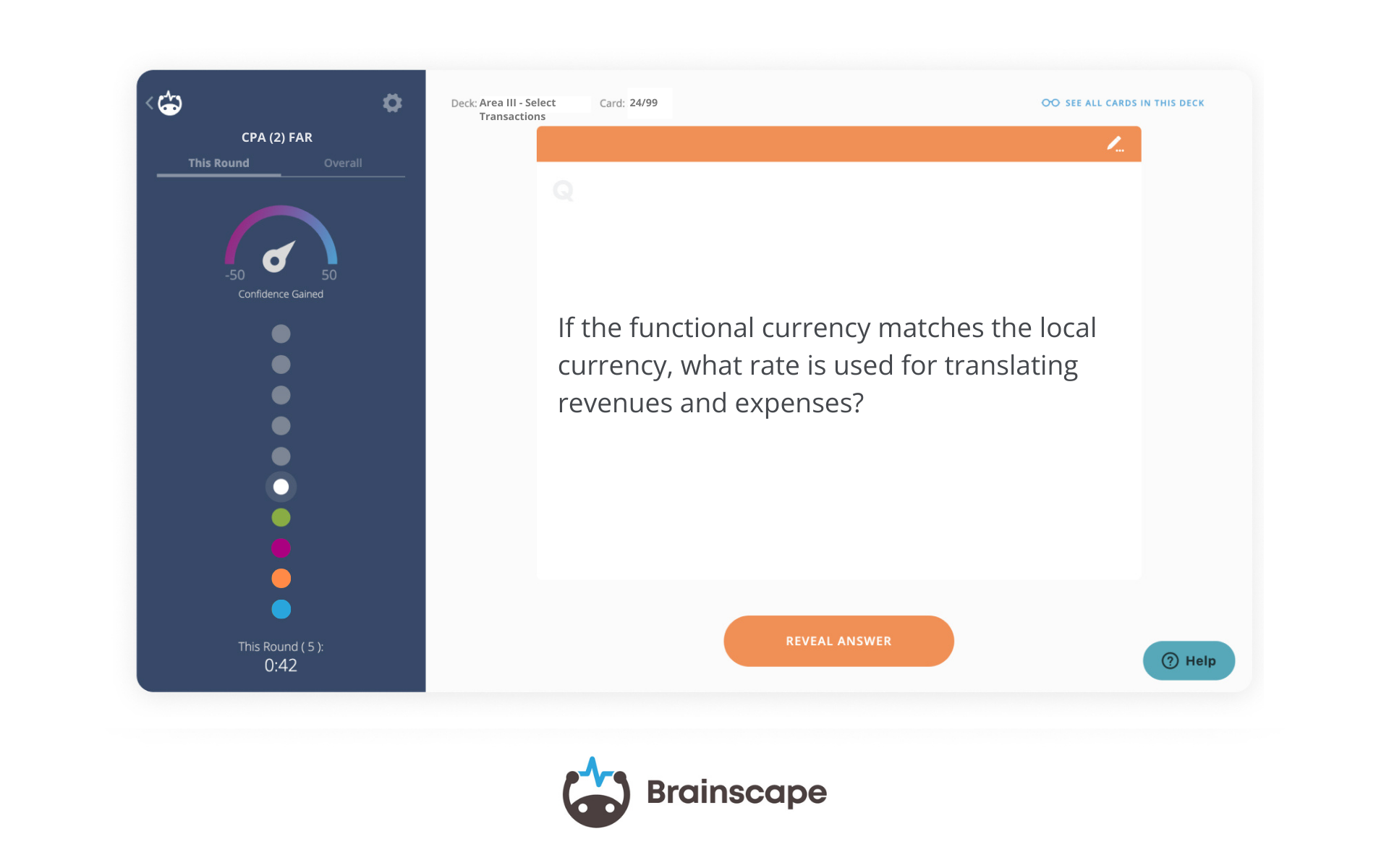

Yes, flashcards, especially digital FAR flashcards, are a very effective study tool for the FAR’s hardest topics because they help you review and memorize exam information quickly. They’re especially helpful for the kind of dense material you need to recall instantly under exam pressure, such as standards, formulas, and journal entry rules.

Digital flashcard apps, like Quizlet or Brainscape, are especially effective for mastering FAR’s toughest content because they rely on three core learning principles: spaced repetition, active recall, and metacognition.

Spaced repetition means reviewing material at increasing intervals over time, rather than cramming it all at once. Your mind forgets 50% of the information you see for the first time, so it requires repeated exposure to commit it to memory. For example, if you’re memorizing a formula, you might see a card again the next day, then three days later, then a week later. Each time you recall it correctly, the gap between reviews gets longer. This timing is deliberate: your brain is challenged to retrieve the information just before it would normally forget it, which strengthens the memory far more effectively than rereading.

Active recall is about forcing yourself to pull the answer out of your memory, rather than recognizing it on the page. If a flashcard asks you to list the five lease classification criteria, you have to reconstruct them yourself before flipping the card. That mental struggle (even if you get it wrong) is what builds durable knowledge. Compare that to passively highlighting a textbook, which feels productive but doesn’t actually test whether you could recall the rule on exam day. Active recall helps you learn more than twice as quickly as passive study strategies.

Finally, metacognition is the skill of monitoring your own learning: in other words, knowing what you know and what you don’t. After each flashcard, you need to rate how well you knew that information, which improves your memory. By allowing you to provide instant feedback on your strengths and weaknesses, digital flashcards improve your self-awareness. This allows you to target your study time where it will have the most impact, instead of wasting hours reviewing concepts you’ve already mastered.

Together, these three principles make digital flashcards one of the most efficient study tools available. Plus, they take the guesswork out of wondering what to work on today, which improves study motivation. Simply open an app that uses a spaced repetition algorithm (such as Anki or Brainscape), and you can start studying straight away. By reducing the cognitive fatigue of working out what to study, your brain has more energy to focus on learning.

For FAR, where you need to juggle hundreds of standards, formulas, and exceptions, the combination of spaced repetition, active recall, and metacognition can mean the difference between a hazy recollection and a confident answer under exam pressure.

Getting Over The FAR Hurdle: Master The Monsters First

FAR is conquerable, especially if you tackle the toughest topics head-on. Focused study combined with digital flashcards leads to better retention and less overwhelm. Start reviewing the hardest topics now to make exam day feel easier. Yes, it’s a mountain of content, but all you need is a clear strategy and the right tools, and you’ll have a pathway to the top!

FAQs: What CPA Candidates Ask About FAR’s Difficulty

What’s The Hardest Section Of The CPA Exam?

Many say that FAR is the hardest section of the CPA exam due to the breadth and memorization load.

How Many Hours Should I Study For FAR?

Candidates typically require 150 to 200 hours of study for FAR, depending on their background.

Is FAR Harder Than REG/AUD/BEC?

For many, yes, FAR is more content-heavy than REG/AUD/BEC, although difficulty is subjective and depends on your previous experience.

What’s The Pass Rate For FAR?

Historically, the pass rate for FAR has been around 45 to 50%.

Should I Study FAR First Or Last?

It depends on your strategy. Many students study FAR first while their motivation is high.

How Do I Retain All The FAR Material?

The best way to retain all the FAR material is to combine study with spaced repetition flashcards and completing frequent practice problems.

References

Ebbinghaus, H. (1913). Memory: A contribution to experimental psychology. New York: Teachers College, Columbia University.

Karpicke, J. D. (2012). Retrieval-based learning: Active retrieval promotes meaningful learning. Current Directions in Psychological Science, 21(3), 157-163.

Job, V., Dweck, C. S., & Walton, G. M. (2010). Ego depletion—Is it all in your head? Implicit theories about willpower affect self-regulation. Psychological Science, 21(11), 1686-1693.

Orbell, S., & Verplanken, B. (2010). The automatic component of habit in health behavior: Habit as cue-contingent automaticity. Health Psychology, 29(4), 374.

Sadler, P., & Good, E. (2006). The impact of self- and peer-grading on student learning. Educational Assessment, 11(1), 1–31. https://doi.org/10.1207/s15326977ea1101_1