Cost Classification and Cost Behaviour Flashcards

(33 cards)

Accounting =

A process of identifying, recording, processing, summarizing and reporting economic information to decision makers

Financial accounting

Focuses on the specific needs of decision makers external to the organization, whereas

Management accounting =

Focuses on the specific needs of decision makers internal to the organization

The Nature of Accounting

- Accounting systems are therefore designed to meet the needs of the decisions makers who use the accounting information.

- Every business has some sort of accounting system.

- These accounting systems may be very complex or very simple, but the real value of any accounting system lies in the information that the system provides.

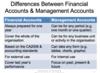

The major distinction between financial and management accounting is…

The users of the information.

- Financial accounting serves external users.

- Management accounting serves internal users, such as top executives, management, and administrators within organizations.

Differences Between Financial Accounts & Management Accounts

Cost =

The amount of expenditure incurred on or attributable to a specified thing or activity.

Cost Unit =

The unit of a product or service in relation to which costs are ascertained

Why Are Costs Required?

Businesses require the cost of a:

- Department

- Cost centre

- Product or service

Why?

- Statutory requirement

- Decision making

- Planning and control

- Performance measurement

Classification of Costs

Costs can be grouped in a number of ways based on the purpose for which they are required.

Classifications include:

- Prime Cost & Manufacturing Overhead

- Product vs. Period costs

- Direct vs. Indirect costs

- Opportunity and sunk costs

Prime Cost =

Prime cost refers to the direct costs of the product & consists of direct labour plus direct material plus any direct expenses such as the cost of hiring a machine for producing a specific product .

Manufacturing Overhead =

Manufacturing overhead consists of all indirect manufacturing labour & material costs plus indirect manufacturing expenses such as rent of the factory & depreciation of machinery.

Product =

Product costs are those costs associated with goods or services purchased, or produced, for sale to customers (in other words, these are the production costs).

Period Costs

Period costs are those costs which are treated as expenses in the period in which they are incurred (in other words, these are the selling & administrative expenses).

Costs that are assigned to cost objects can be divided into two categories: direct costs & indirect costs.

- Direct costs are those costs that can be specifically & exclusively identified with a particular cost object.

- Indirect costs cannot be identified specifically & exclusively with a given cost object.

An Important remark about indirect and direct costs:

- The definition of direct and indirect costs depends on the purpose for which the cost will be used.

For example, the salary of a project manager is indirect cost to the company but a direct cost to the project.

Opportunity Costs =

An opportunity cost is the benefit foregone for not taking the next best alternative

Example - A proposal to make a newly-developed product offers an NPV of £3m. An alternative is for the firm to sell the patent for £4m to another firm for it to make the product.

NPV £3m

Opportunity cost £4m

NPV (£1m)

Sunk Costs =

Sunk costs are costs which arose as a result of past decisions and do not affect a decision currently under consideration

E.g. An oil company has incurred £2m conducting exploratory studies to identify the best sites for drilling. Is this a relevant cost to the current proposal to sink a well?

Variable Costs =

- Variable costs are those costs which vary in direct proportion to the volume of activity. So, doubling the level of activity will double the total variable cost.

- Consequently, total variable costs are linear & unit variable cost is constant.

- The following example illustrates a variable cost where the variable cost per unit is £10

Examples of Variable Costs:

- Materials used to manufacture a unit of output or to provide a type of service;

- Hourly paid / unit paid Labour costs of manufacturing a unit of output or providing a type of service;

- Commission paid to a salesperson.

Fixed Costs

- A fixed cost is one that is not affected by changes in the level of activity, for a specified period of time and within a specified range of activity.

- Total fixed costs are constant for all levels of activity whereas unit fixed costs decrease proportionally with the level of activity.

Graph of Total Fixed Cost against Activity

Graph of Unit Fixed Cost against Activity

Examples of Fixed Costs

- Advertising in the trade journals

- Salaries & wages of administrative duties

- Depreciation of building