Week 6 - Introduction to management accounting & costing concepts Flashcards

(33 cards)

What is management accounting? (Horngren et al 2014, p.21)

- Is the branch of accounting that produces information for managers within an organisation

- Its the process of identifying, measuring, accumulating, analysing, preparing, interpreting and communicating information that helps managers fulfill organisational objectives

Examples of management accounting uses

- Price setting

- Investment decisions

- Growth strategies - either new customer or product

- Cost leadership or differentiation strategy

- Recruiting new staff

- Undertake new marketing campaign

3 processes of management accounting

- Planning

- Controlling

- Decision making

Planning process of management accounting

- Establish goals

- Specify how goals will be achieved

- Develop budgets

Controlling process of management accounting (2)

- Gather feedback to ensure that plans are being followed

- Feedback in the form of performance that compare actual results with the budget are an essential part of the control function

Decision making process of management accounting (2)

- Involves making a solution among competing alternatives

- E.g what should we be selling

The cost hierarchy

Define cost object

Any activity for which a separate measure of cost is required (e,g a product, service, business unit etc)

Define cost driver

The activity lies that consumes resources and hence incurs cost e.g labour hours, machine hours, order size, travel distance etc

Define direct cost

Any cost which can be specifically and exclusively identified with a particular:

- direct materials

- direct labour

Define indirect cost (overheads)

Any costs which cannot be specifically and exclusively identified with a particular cost object:

- indirect materials

- indirect labour

Examples of manufacturing costs (3)

- Direct materials - are integral parts of the product

- Direct labour

- Manufacturing overheads - costs that cannot be directly traced to specific units produced

Define indirect labour

Wages paid to employees who are not directly involved in production work e.g maintenance workers, janitors and security guards

Define indirect materials

- Materials use to support the production process

- Example: lubricants and cleaning supplies used in the automobile assembly plants

Types of non manufacturing costs (2)

- Marketing and selling costs - costs necessary to get the order and deliver the product

- Administrative cost - all executive, organisational and electrical costs

Define variable costs

Any cost which varies indirect proportion to the activity level

Define fixed costs

Costs which remain constant over a wide range of activity levels within a business

Define mixed costs (semi-variable)

Costs which have both a fixed a variable element to them

Define stepped fixed costs (semi-fixed)

Costs which remain constant within a given range of activity, but which increases or decreases by a set amount at various critical activities

Gross profit formula

Sales revenue - manufacturing cost

Contribution formula

Sales revenue - variable cost

Total fixed cost graph

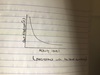

Unit fixed cost graph

Total variable cost graphs