Week 9 Flashcards

(40 cards)

Malkiel’s rules

- There is an inverse relationship between bond prices and yields;

- A decrease in a bond’s yield to maturity causes a larger change in the bond’s price than an increase in yield of the same size does;

- The prices of long-term bonds exhibit greater sensitivity to interest rate movements than those of short-term bonds;

- Although the sensitivity of bond prices to yield changes rises with their maturities, it does so at a decreasing rate;

- There is a negative relationship between the sensitivity of bond prices to interest rate changes and the rate at which they pay coupons; and,

Homer and Liebowitz

Bonds with higher yields to maturity are less sensitive to changes in yield than bonds with lower yields to maturity.

Duration is an important tool when managing a bond portfolio because

in addition to measuring the effective average maturity of the portfolio, it:

Indicates how sensitive a portfolio is to changes in interest rates; and

Can be used as a tool in immunising the portfolio against interest rate risk.

Rule 1 for Duration

A zero-coupon bond has a duration equal to its maturity;

Rule 2 for Duration

A bond’s duration is lower when the coupon is higher

This is because, as the coupon rate rises, so too do the weightings on the bond’s earlier coupons and, therefore, the weighted average maturity of all the bond’s cash flows falls

Rule 3 for Duration

a bond’s duration increases with its time to maturity

duration always increaese with maturity for bonds selling at par or at a premium to par

Rule 4 for duration

the duration of a coupon bond is higher when the bond’s yield to maturity is lower

This is because, as the bond’s yield increases, a larger proportion of the total value of the bond lies in its earlier payments, reducing its effective maturity;

RUle 5

The duration of a level perpetuity is (1+y)/y, showing that an instrument’s maturity and duration can be materially different;

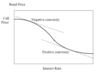

while duration is a good approximation for

while duration is a good approximation for small yield changes, it is less so for larger changes

b/c relationship between the percentage change in the price of a bond against the change in its yield is not linear

investors view convexity as an attractive characteristic of bonds. More specifically:

Bonds exhibiting greater curvature in the price- yield curve enjoy greater price gains when yields fall than they suffer price falls when yields rise; but,

Investors view convexity as an attractive characteristic of bonds but

investors will need to pay a higher price and accept lower yields to maturity on bonds with greater convexity

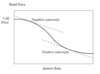

connvexity concepts for callable bonds.

When interest rates are high

the price-yield curve is convex in the way it is for straight bonds. More formally, the curve exhibits positive convexity, or the price-yield curve sits above its tangency line;

connvexity concepts for callable bonds.

When interest rates are low

the price-yield curve exhibits negative convexity, or an area where the price-yield curve falls below its tangency line;

connvexity concepts for callable bonds.

The negative convexity of part of the price-yield curve is

a result of the face the bond cannot have a value greater than its call price, or it being subject to price compression as yields fall.

Duration and convexity of callable bonds

as rates fall, we sometimes say the bond is

subject to a price compression - its value is compressed to the call price (bond cannot be worth more than the call price)

Duration and convexity for callable bonds

Indeed, negative convexity is unattractive to investors, as

it indicates that price falls for a given interest rate rise will be greater than price rises for equivalent rate rises. This is a result of the bond issuer having the choice of calling the bond back

Duration and convexity for callable bonds

negative convexity

what happens when interest rate rises

the bondholder loses as would be the case for a straight bond

Duration and convexity for callable bonds

negative convexity

interest rates fall?

investor may have the bond called back from her

the bondholder is in a lose lose situation

Duration and convexity for callable bonds

negative convexity is an unattractive feature but

the bondholder is compensated for this unattractive situation when she purchased the bond b/c callable bonds sell at lower initial prices than straight bonds

duration and convexity of callable bonds

Another implication of bonds being callable is that

that their future cash flows are no longer known. Indeed:

If a bond is called early, its face value will be repaid early and all subsequent cash flows would not be paid. Given this, using Macaulay’s duration approximation to ascertain the sensitivity of bond prices to changes in yields is not advisable; and,

Instead, industry practice th compute the effective duration of bonds with embedded options

Two main types of passive strategies are employed in managing fixed-income portfolios

including

Attempting to mimic the performance of a predetermined bond index

and

Trying to immunise the portfolio from interest rate movements, or match the duration of the portfolio’s assets with that of its liabilities. (seeks to estalbish zero-risk profile where interest movements would have no impact on value of firm)

Two main types of passive strategies are employed in managing fixed-income portfolios

including

Attempting to mimic the performance of a predetermined bond index. T

similar to stock market indexing, except the relatively high number of securities included in the former together with greater rebalancing difficulties mean indexes are not mimicked as precisely as they are in stock market indexing

replicate the performance of a given bond index

immunization

banks and thrift institutions

mismatch between asset and liability maturity structures

Bank liabilities (deposits owed to customers) are of low duration

Bank assets (oustanding commercial and consumer loans and mortgages) are of longer duration –> more sensitive to interest rate fluctuations –> increase unexpectedly = assets fall in value more than liabilities

immunization

banks and thrift institutions

mismatch between asset and liability maturity structures

Bank liabilities (deposits owed to customers) are of low duration

Bank assets (oustanding commercial and consumer loans and mortgages) are of longer duration –> more sensitive to interest rate fluctuations –> increase unexpectedly = assets fall in value more than liabilities